Overview

Investment tax withholding involves a combination of constituent, investment system, and IRA account settings. Investment withholding amounts are then collected during various investment transactions based on the investment withholding settings.

Setup

Constituent Setup

| AI Code |

Description |

Notes

|

| TAXF |

Foreign Tax Constituent |

Withholding always equals 0%

|

| TAXN |

Non-Taxable Constituent |

Withholding always equals 0%

|

| TAXW |

Tax Withholding Constituent |

Tax-withholding is required based on investment system settings and IRA account settings

|

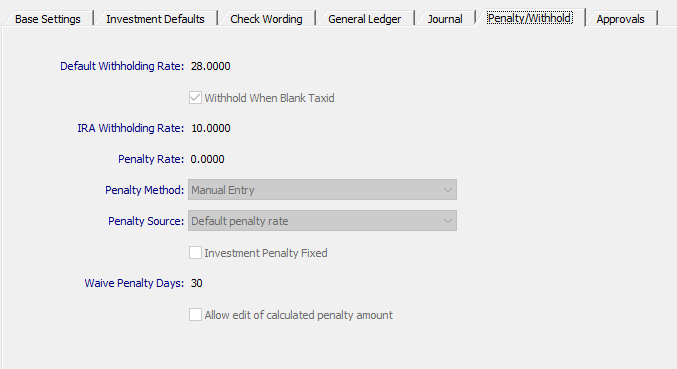

Investment System Settings

| Field |

Description

|

| Default Withholding Rate |

Amount of investment withdrawal and/or interest payment withheld when required. Associated with investments other than IRAs. Can be used in combination with the Withhold when blank taxid field in this window. If the IRS notifies your organization to withhold from a certain individual, attach the code “TAXN” to the name/address record of the investor

|

| Withhold When Blank Taxid |

Indicates whether or not to withhold interest when investor’s tax ID number is blank within their Account. If selected, the system will withhold even if investor's tax ID number is blank

|

| IRA Withholding Rate |

Amount of investment withdrawal and/or interest payment withheld when required. Associated with IRA investments

|

| Penalty Rate |

Percentage penalty assessed in the event a term investment is redeemed prior to maturity

|

| Penalty Method |

How the penalty amount is assessed in the event a term investment is redeemed prior to maturity. Click the drop down arrow to select from a list of active penalty methods configured in the system. For information on how penalty methods are calculated, please reference this document: Early Redemption Penalty Options

|

| Penalty Source |

Used to identify the rules followed when determining the appropriate penalty rate on each investment. Click the drop down arrow to select from a list of active penalty source codes configured within the system

|

| Investment Penalty Fixed |

Indicates whether the penalty rate for an investment remains fixed or fluctuates. Used in tandem with the Penalty Method and Penalty Rate fields. If selected, the investment penalty is fixed

|

| Waive Penalty Days |

This allows clients to initiate an investment withdrawal within a certain number of days of the purchase date without applying penalty. Sometimes the investor does not send in instruction on what to do when an investment matures until after the maturity date. In this case a new investment may have already been created with a new purchase date. This setting controls whether the system tries to collect penalty on an investment that is being redeemed prior to maturity

|

| Allow edit of calculated penalty amount |

If this option is selected, users with the appropriate security will be able to override the system calculated penalty amount on the Investment Payout and Investment Transfer and Payout screens

|

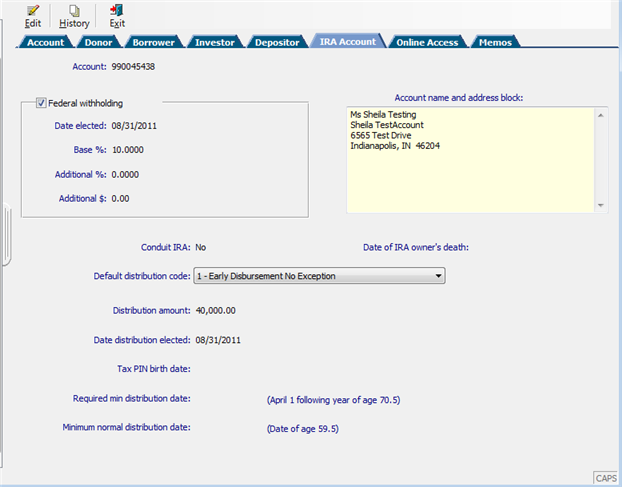

IRA Account

| Field |

Description

|

| Federal Withholding |

Controls whether or not federal tax is withheld for withdrawals from any IRA under this master account (in the percentages or dollar amount identified)

|

| Date elected |

Date when federal tax withholdings began

|

| Base % |

Base federal-tax withholding percentage. This is a display only field, and will not have an effect on monies or calculations

|

| Additional % |

Any percentage additional federal-tax withholding above the base percentage

|

| Additional $ |

Any dollar amount additional federal-tax withholding above the base percentage

|

| Conduit IRA |

Whether or not an IRA under this master account serves as merely a transitional stage between one qualified plan (401(k), 403(b), etc.) and another qualified plan

|

| Date of IRA owner's death |

Date when the IRA owner (tax ID) died, if applicable

|

| Default distribution code |

Code representing the default IRS code to use on withdrawal transactions. Click the drop down arrow to the right of the field to select from the list of options

|

| Distribution amount |

Dollar amount to distribute from an IRA under this master account, in the manner identified by the default distribution code (if applicable)

|

| Date distribution elected |

Date when account owner has asked to receive a specified distribution amount

|

| Tax PIN birth date |

Birth date of constituent with account-master tax ID. Derived from Name/Address record (display only)

|

| Required min distribution date |

April 1 following the date when the master account’s “Tax ID” constituent will reach the age of 70.5. This is the age when a minimum IRA distribution is required. Calculated based on the constituent’s birth date (display only)

|

| Minimum normal distribution date |

Date when the master account’s “Tax ID” constituent will reach the age of 59.5. This is the age when this individual first becomes eligible for a minimum distribution. Calculated based on the constituent’s birth date (display only)

|

Withholding Rules

| Priority |

Details

|

| 1 |

Find tax reporting constituent on provided investor account

|

| 2 |

Determine whether investor account is an IRA or not

|

| 3 |

If IRA then determine withholding percentage equal to default IRA withholding rate plus any additional withholding percentage defined at the IRA account level. Also return the default withholding amount defined at the IRA account level.

|

| 4 |

If constituent is a foreign tax constituent (TAXF) or a non-tax constituent (TAXN) then don't withhold any amount

|

| 5 |

If constituent has a blank taxid and investment system setting is setup to withhold from blank taxids then the withholding percentage equals the default withholding rate defined in Investment System Settings

|

| 6 |

If constituent is a tax withholding constituent (TAXW) then the withholding percentage equals the default withholding rate defined in Investment System Settings

|

| 7 |

All other scenarios do not involve withholding

|

Areas involving withholding

Withholding is only assessed on investment accrued interest during the events below.

- Investment Transfer and Payout

- Investment Payout and Compound

- Investment Maturity Processing

- Daily Investment Interest Processing

- Investment Premium Payment